:max_bytes(150000):strip_icc()/dotdash_Final_Strategies_Applications_Behind_The_50_Day_EMA_INTC_AAPL_Jul_2020-03-4913804fedb2488aa6a3e60de37baf4d.jpg)

And in reverse, when the price moves below the 50 period moving average from above, it is considered to be a shift in sentiment from bullish to bearish. Furthermore, when the price moves above the 50 period moving average from below, it is considered to be a shift in sentiment from bearish to bullish. On the contrary, when price is trading below the 50 period simple moving average line, it is considered a bearish trend.

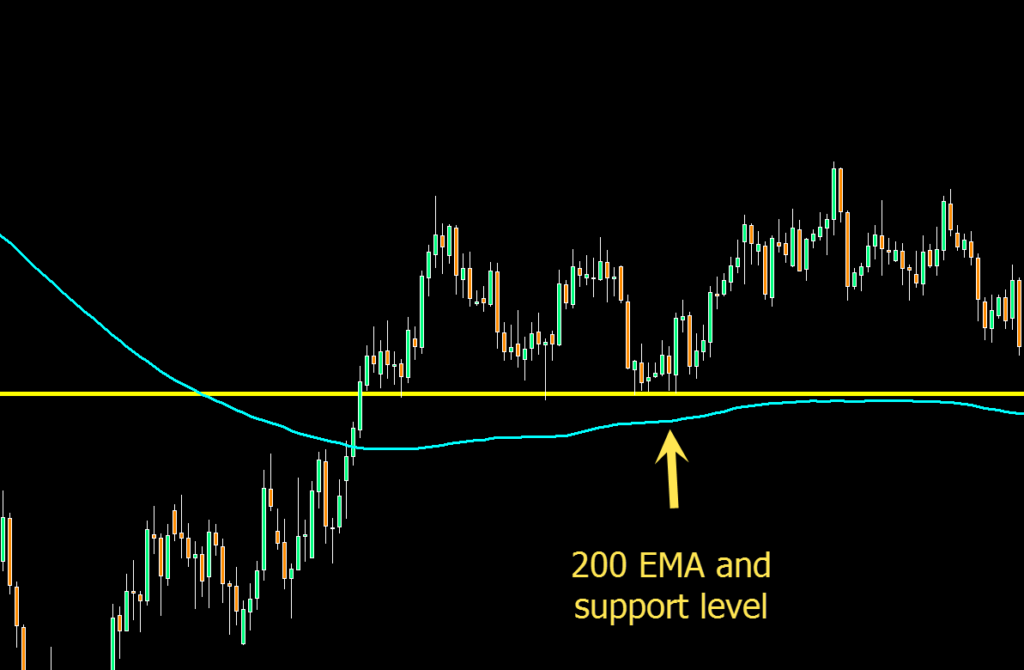

Here’s an example of the 50 period SMA line applied to the spot Silver price chart:Īt the most basic level, when price is trading above the 50 period simple moving average, it is considered a bullish trend. Since the 50 day moving average consists of a total of 50 price bars in its calculation, it tends to be quite smooth as compared to the shorter-term averages such as the popular 20 period moving average line. It is considered an intermediate-term trend filter, and one that many swing traders rely on. The 50 period simple moving average is quite popular in the stock indexes, currencies, and commodities markets. The first is the 50 day simple moving average line. Now that we have a basic understanding of how moving averages are constructed and some of the different variations, let’s now move on to discussing two of the more widely followed moving average lines. They tend to correlate quite highly with each other in most cases. So the obvious question becomes which is a better moving average to use for the purposes of trading the markets? From my research, I have not found that one is statistically more reliable than the other in terms of trend identification. Because of this, EMA’s tend to be more sensitive to recent changes in price action. Essentially, exponential moving averages factor in recent data points more heavily than latter data points. They were designed to reduce the overall lag that are inherent within simple moving average lines. The exponential moving average, also referred to as EMA is a bit more complex than the simple moving average.

As a new data point is introduced, it is incorporated into the calculation while the last data point is removed from the calculation. Each period is weighted equally in the calculation and the overall construction of the simple moving average line.įor example, a 20 period simple moving average line would be calculated by averaging the closing prices of the last 20 days. The simple moving average, also known as SMA, is calculated using the average price of an instrument over a specified number of periods. The first variation is the simple moving average and the second variation is the exponential moving average. There are two primary types of moving averages that are used in financial speculation. Obviously, we should be using additional technical analysis techniques in conjunction with the moving average trend filter to time our trades. So when the markets are trending in one direction, as evident from our moving average study, the probabilities favor that continued price action in that direction is more likely.

One of the best ways to use moving averages is as a trend filter. Some traders may find this characteristic unappealing but, nevertheless, the proper application of moving average lines can be quite useful. However it’s important to understand that a moving average is a lagging indicator, and thus are most useful in defining what price has done in the past rather than what price is likely to do in the future. The primary function of moving averages is to help smooth the price data so that we can better gauge the overall price action of a trading instrument.

#50 200 ema strategy download

Click Here To Download Understanding Moving Averages

#50 200 ema strategy pdf

Download the short printable PDF version summarizing the key points of this lesson….

0 kommentar(er)

0 kommentar(er)